ZenPay Neo Banking Platform

Build the future of digital banking with scalable, API-first infrastructure that powers

real-time accounts, seamless onboarding, multi-currency management

and

compliance-ready operations.

KYC Onboarding

Digital-first onboarding with eKYC, CKYC, and biometric verification.

Automated risk profiling to meet AML and compliance requirements

Instant identity validation through government APIs and third-party providers.

Scalable flows for individuals, SMEs, and enterprise clients.

Fully paperless account opening with secure document upload.

Multi-Currency Accounts

Hold balances in multiple currencies with instant wallet conversion.

Customer-controlled currency preferences for domestic and international payments.

Real-time FX rates and transparent fee structures

Support for remittances and global commerce transactions.

Cross-border readiness with swift settlement rails.

Ledger & Core Banking

Real-time transaction posting with a double-entry ledger system

Support for savings, current, and business account structures.

Automated reconciliation for balances, fees, and interest.

Audit-ready logs with role-based access.

Configurable accounting and reporting hierarchies.

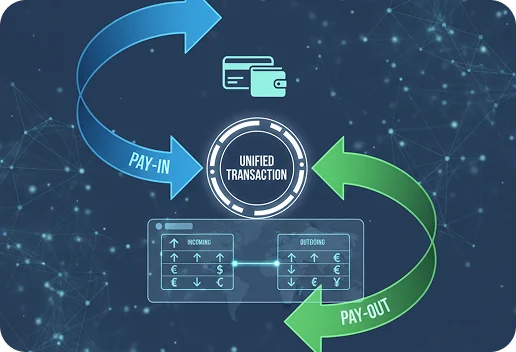

Pay-in & Payout Orchestration

Unified API for collections and disbursements across multiple channels.

Integrated with UPI, IMPS, NEFT, RTGS, cards, and wallets.

Bulk payouts for payroll, refunds, vendor settlements.

Instant status tracking and settlement notifications.

Flexible routing and prioritization rules for cost optimization.

Reconciliation & Reporting

Automated daily reconciliation of payments and settlements.

On-demand report export in PDF, CSV, and XLS formats.

Mismatch detection and alerting for unresolved transactions.

Regulatory-ready reporting templates for audits.

Intuitive dashboards with drill-down views by customer, merchant, or branch.

Ready to save time and launch 10X faster?

Start your journey with ZenPay — fast, flexible, and future-ready.